How Trump’s Tariffs and $36 Trillion Debt Impact DFW Real Estate in 2025

🧠 The Big Picture: Why Everyone’s Talking About the Market

As mortgage rates fluctuate and news headlines talk about government debt and market instability, many homebuyers and sellers in the Dallas-Fort Worth (DFW) area are wondering how these issues affect the local real estate market. In 2025, two major economic developments are creating concern and uncertainty: the U.S. government’s rising national debt and the impact of new tariffs imposed by former President Trump.

This blog will help you understand how these financial factors can directly influence mortgage rates, home prices, and the overall housing market in the DFW Metroplex.

💸 The $36 Trillion Question: What’s Going On?

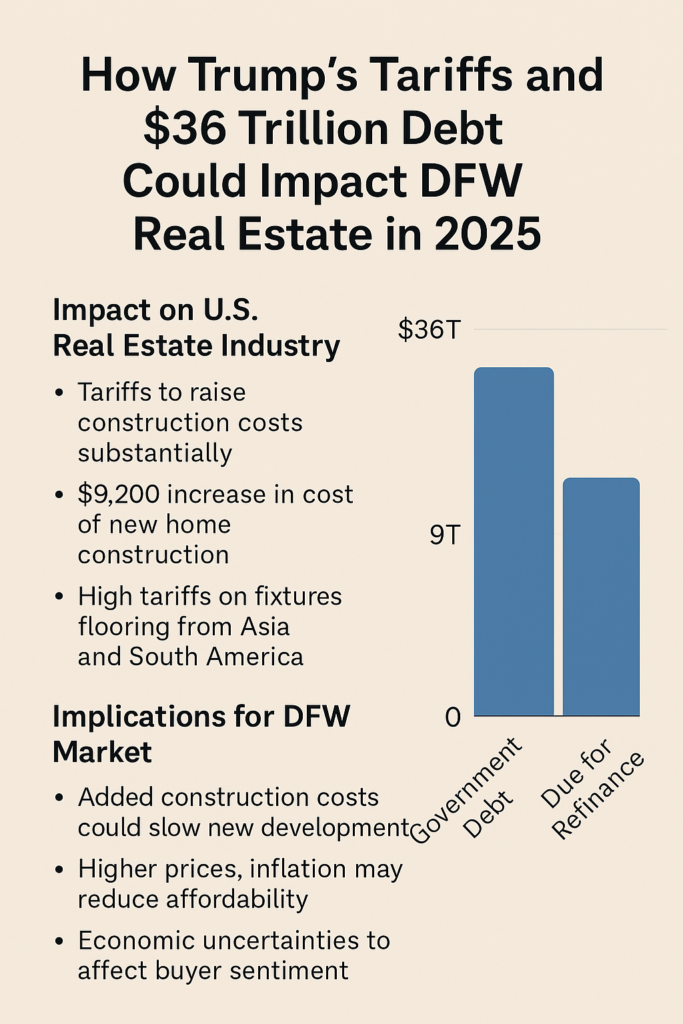

The federal government currently holds over $36 trillion in national debt. Of that amount, approximately $9 trillion must be refinanced in 2025. Refinancing debt works similarly to refinancing a home loan: if interest rates are low, payments are manageable. If rates are high, the cost of borrowing increases dramatically.

The U.S. Treasury needs to issue new bonds to pay off this maturing debt. The interest rates on these new bonds will impact the government’s future budget and overall deficit.

📉 How the Market Reacts: Bonds, Fear & Rates

Here’s how the national debt and government refinancing impact everyday consumers:

- When the government needs to refinance large amounts of debt, it often raises interest rates to attract buyers for its bonds.

- Higher government bond yields usually result in higher mortgage rates for homebuyers.

- If economic uncertainty grows, investors often buy U.S. Treasury bonds as a safe haven. This increased demand pushes bond prices up and yields down, which can lead to lower mortgage rates temporarily.

- Mortgage rates often follow the 10-Year Treasury yield. When that yield falls, mortgage rates usually follow.

🔺The Role of Tariffs and Construction Costs

In addition to refinancing challenges, recent tariffs on imported materials have pushed construction costs higher. This affects homebuilders and ultimately, homebuyers.

According to the National Association of Home Builders (NAHB):

- The average cost to build a new home has increased by approximately $9,200 due to these tariffs.

- Materials like flooring, appliances, and fixtures sourced from countries like China, Malaysia, and Indonesia now carry import taxes as high as 54%.

- Builders may reduce the number of homes they start due to rising costs, which can lead to fewer new homes on the market.

🏠 Real Estate & Rates: The DFW Perspective

The Dallas-Fort Worth metro area has been one of the fastest-growing real estate markets in the country. While DFW has benefited from population growth, job expansion, and demand from out-of-state buyers, it is still influenced by national economic conditions. Here is how the current financial situation could impact the local housing market:

- If borrowing becomes more expensive due to high interest rates, fewer buyers may qualify for mortgages, reducing demand.

- Rising construction costs can slow down the building of new homes, leading to lower housing supply.

- A temporary dip in mortgage rates due to bond market activity could create a short window of opportunity for buyers to lock in lower monthly payments.

- Current homeowners with locked-in low interest rates may be less likely to sell, further limiting inventory.

- Buyers in DFW may become more cautious, delaying purchase decisions amid financial uncertainty.

🧠 Final Thoughts: What to Do Now?

If you’re:

- Buying → Stay close to rate updates. Even a 0.5% drop can save you thousands.

- Selling → Understand buyer behavior. Now’s the time to attract the “prepared and informed” crowd.

- Investing → DFW remains one of the top metros for long-term growth, especially as people move from high-cost states.

🎯 Want to stay ahead of the curve? 👉 Follow @SamSellsDFW for weekly market insights and buyer-ready opportunities.